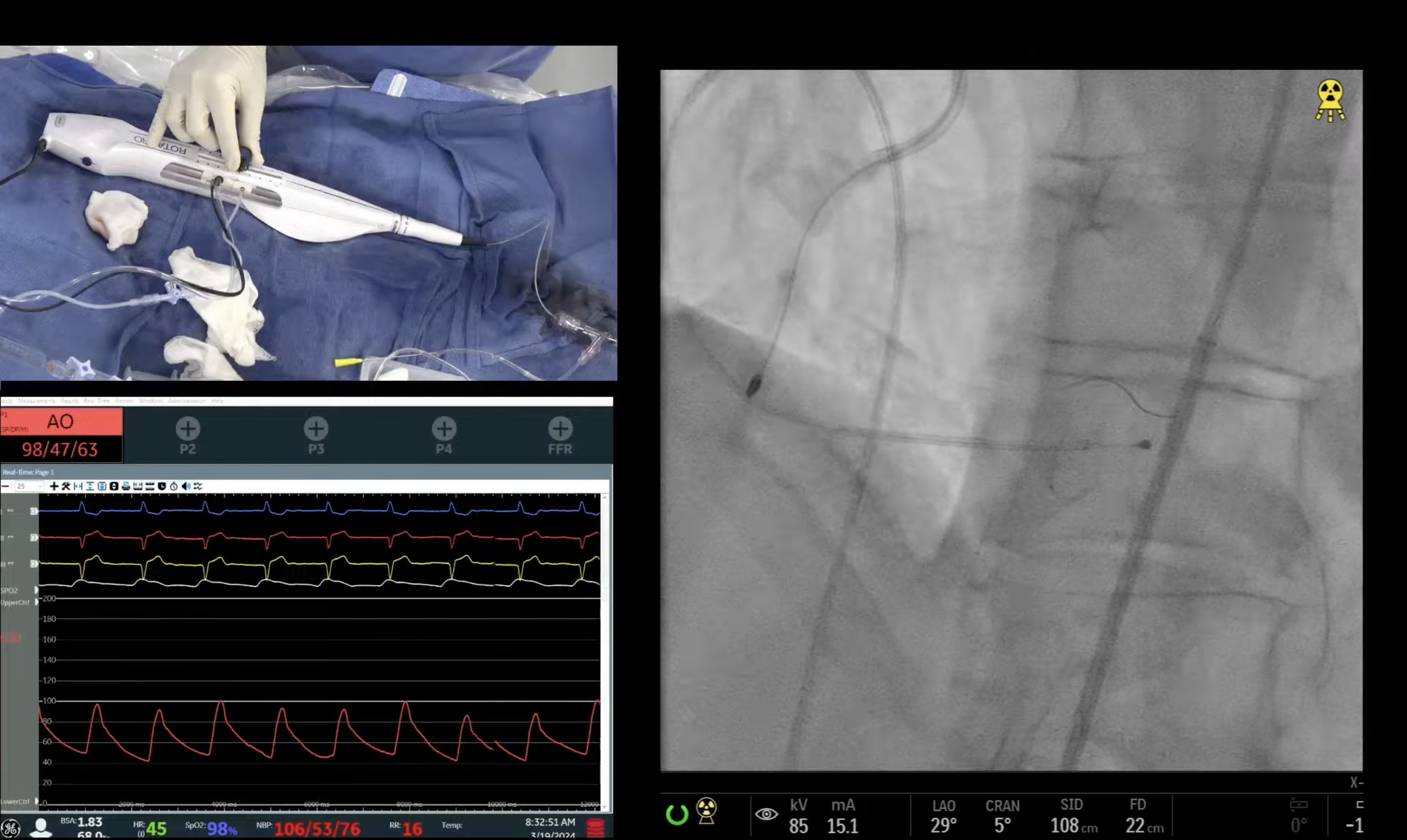

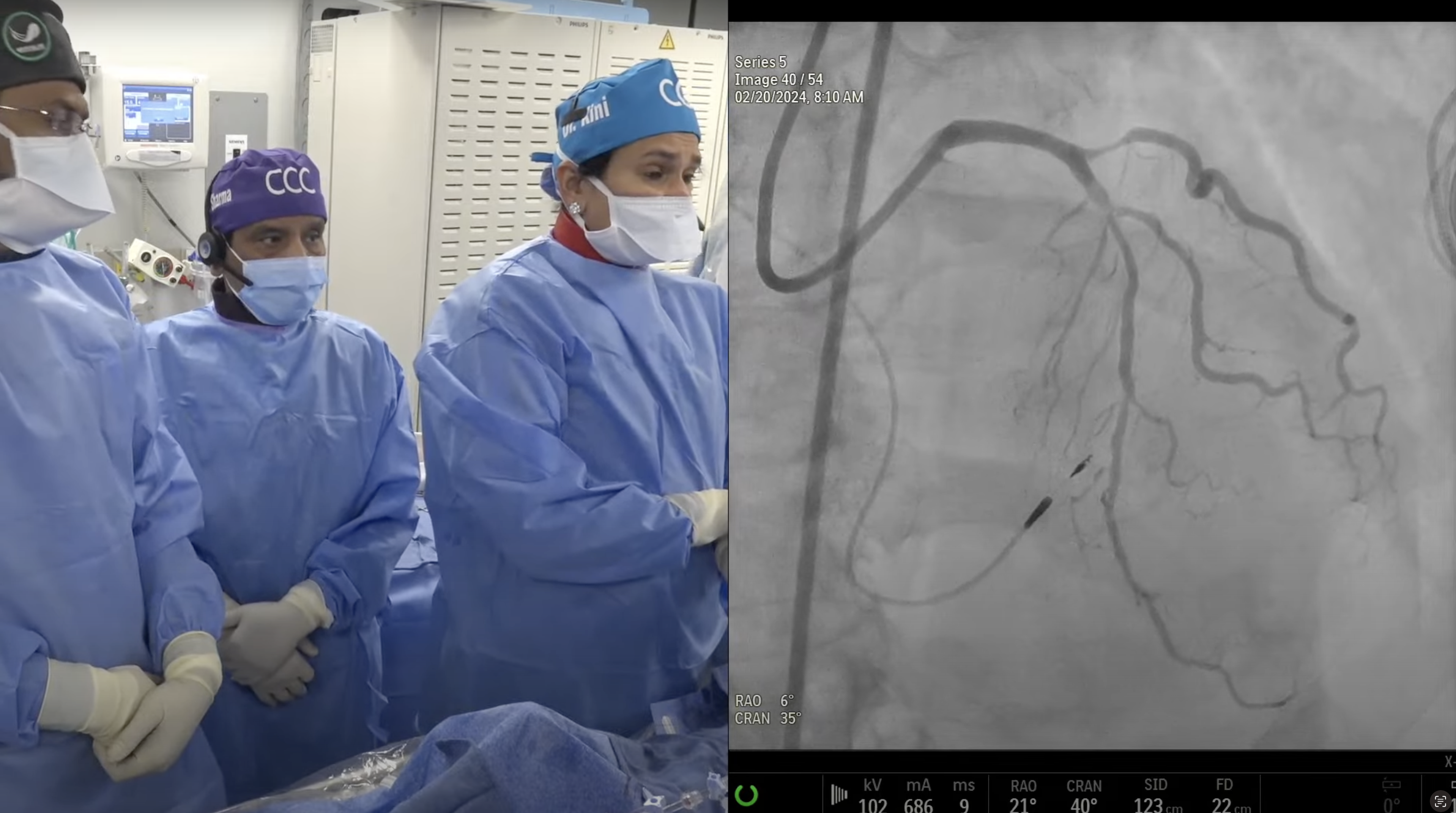

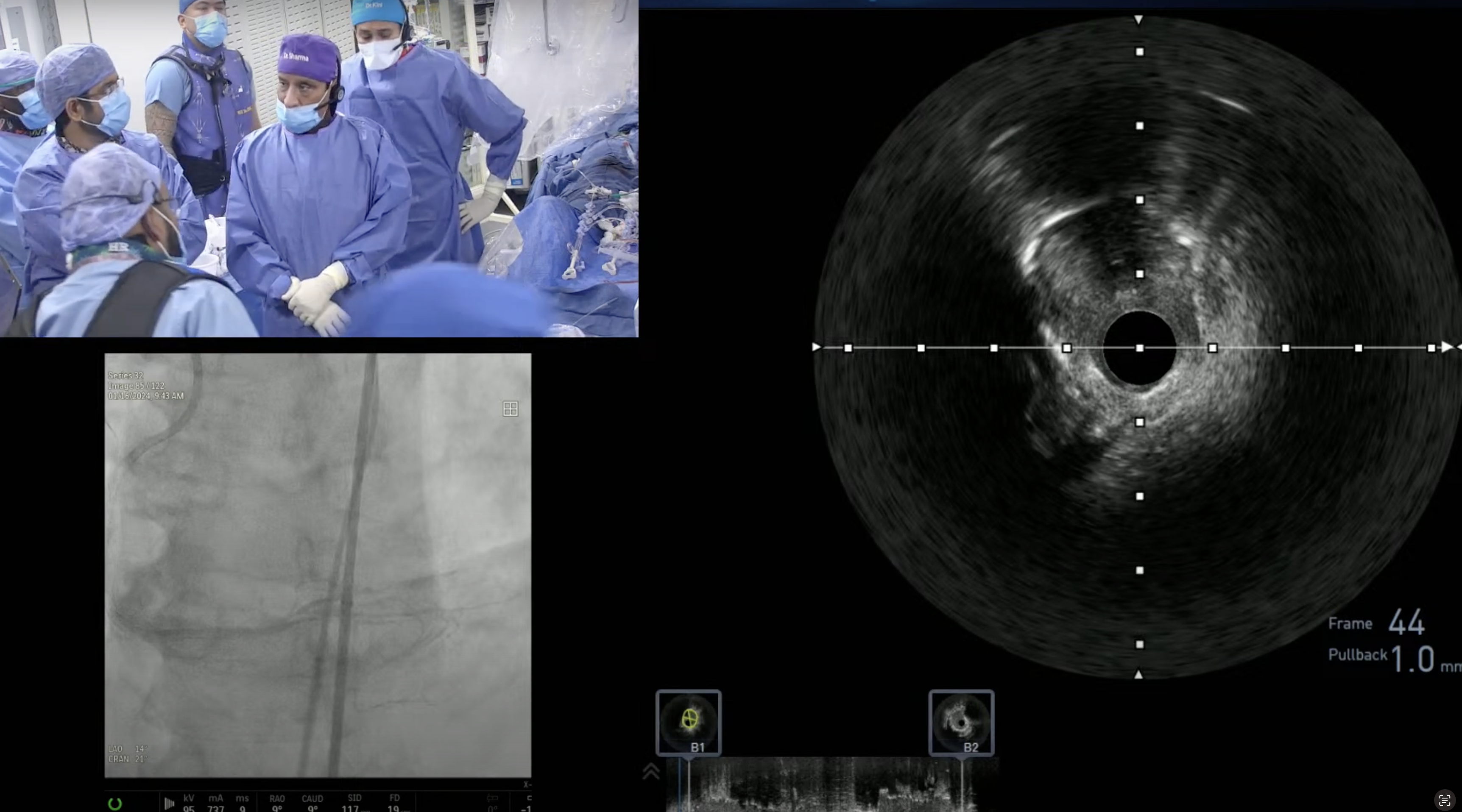

63 year-old male with known CAD, CABG x2 (1999) and multiple PCI’s to SVG to RCA and LCx branches presented with CCS Class IV angina and non-STEMI (TnI 1.2U). A Cardiac Cath on June 22, 2020 revealed patent LIMA to LAD, non obstructive LCx branches with patent prior stents and 90% multilayer in-stent restenosis of SVG to distal RCA (underexpanded stent) and LVEF 60%. Patient underwent partially successful intervention of SVG to distal RCA lesion using PTCA and atherotomy with residual 50% stenosis due to underexpanded stent. Patient is now planned for OCT guided PCI of multilayer underexpanded stent restenosis of SVG to distal RCA using rotational atherectomy (stent ablation with RA).

Q&A

Q

Regarding PCI volumes, do you expect a further decline in volumes in the United States?

A.

I predict another 5-10% decline in PCI volume in USA in next 1-2 years, largely as the impact of the ISCHEMIA trial. Then volume will stabilize just as it did after COURAGE trial in 2006-7 and AUC implementation in 2011-12.

Q

What has been the impact on industry on such a sharp decrease?

A.

Clearly every device industry now focusing more on the Structural Heart disease market which will continue to grow and explode in next decade.

Q

Has structural heart volumes financially compensated?

A.

Structural volume has financially compensated for about 80% of the decline in PCI revenue but will take another year to fully compensate. Big boost will be approval of MitraClip for FMR this year; which is a huge market and will increase the MitraClip volume 3-5x of current volume. Also DRG reimbursement for the MitraClip procedure has also increased since October 2019. (Now it is about 90% of the TAVR DRG reimbursement).

Q

Would this be the trend for the future - plateau PCI and increasing structural heart cases?

A.

Yes I agree plateau PCI volume and increase in Structural volume will be the future interventional trends.

Q

Are these changes happening in Europe too?

A.

Yes similar trend is being observed in Europe and Germany too. But not in Asia.

Q

Why not in Asia - a catch up phenomenon?

A.

In Asian countries, there is still limited widespread availability of PCI with continued rise in CAD incidence. This is the result of higher demand and supply ratio in Asia. Somehow Structural procedures have not taken off in Asia; reasons are not clear.

Q

You mentioned briefly about the volumes in India - perhaps India and China are isolated from these developments as the massive population will remain underserved for years to come?

A.

Fully agree as both countries continue to show steady increase in PCI volumes. India with over 450,000 PCIs annually, now tops Japan for the second spot (USA being #1).

Q

Have the declines in heart surgery affected the financial standings at several hospitals in supporting large surgical teams and anesthetists?

A.

Actually CT surgery volume is getting double hit by lower CABG volume and lower SAVR volumes. Hence every institution, CTS data counts TAVR in their procedural volumes. This decreasing CT surgery trend has reduced the CTS faculty and dedicated cardiac anesthetists.

Q

How do you see the future of STEMI?

A.

STEMI cases also will continue to decline post Covid-19 due to various reasons such as lower air pollution, better food and improved exercise and personal wellbeing. I believe this will be a sustained phenomena.

Q

In view of these seismic changes, how have you recalibrated your training program?

A.

We have already decreased our Interventional fellows from 9 to 7 last year, added 2 Structural fellows and 2 Endovascular fellows. Starting July 2021, we are discussing to decrease Interventional fellows to 6 and increase Structural fellows to 3. This will be the right move keeping in line with the changing interventional landscape.